Remember this wild and crazy guy from late night tv? “You get a grant! And you get a grant! And you get a grant!”

Remember this wild and crazy guy from late night tv? “You get a grant! And you get a grant! And you get a grant!”

He had everybody believing the government had warehouses full of money that was yours for the taking. All you had to do was buy his big book to learn where to hop on the money train.

Thanks to that mightily effective pitch, entrepreneurs across the nation started chasing the elusive government grant believing it was the easiest way to fund their new their businesses. Ah yes, nothing like the promise of free cash to sidetrack the hopeful impresario.

But, that is so 1990! Now our eager wantapreneurs are on the hunt for the crowdfunding platform that promises free money (sort of) to start a business, launch a new product or fund a cherished cause.

The idea of crowdfunding as an easy way of obtaining funds has really gained momentum and taken on a life of its own in the past three to five years.

According to a Wall Street Journal article, the crowdfunding industry grew an astronomical 1000% over a five year period. It’s all good right? Well…

What’s Not to Love?

With a track record like that (keep in mind crowdfunding is still in its infancy), what’s not love? Yeah, well, when it comes to crowdfunding, it’s not all milk and honey in the land of easy money.

When it comes to crowdfunding, it’s not all milk and honey in the land of easy money.

A Crowdfunding Success Story…Or is it?

I won’t name names to protect the gullible innocent, but this is a true story found at OpenForum.com.

A Kickstarter recipient was fully funded to the tune of $100,000 to launch his new product. Wow right? Then the tax man came calling. Taxes you say? Oh yes. Your crowdfunding “winnings” are taxed. Our Kickstarter friend had to pay $30,000 in taxes alone!

Mr. Moneybags also spent $10,000 on a “platform to deliver his product” (presumably a website?) and $50,000 on development of the product. He was then left with $10,000 to market his product.

Sounds like a major win right? Apparently not. In the end he spent all the cash and it still wasn’t enough to properly and fully launch his product.

Say it ain’t so! What happened? Could be that he built his business too fast and too big. By having all that available cash he jumped full in without considering the long term plan or consequences. It backfired.

That scenario has been playing out more and more to unsuspecting crowdfunded “winners”.

More Crowdfunding Reality

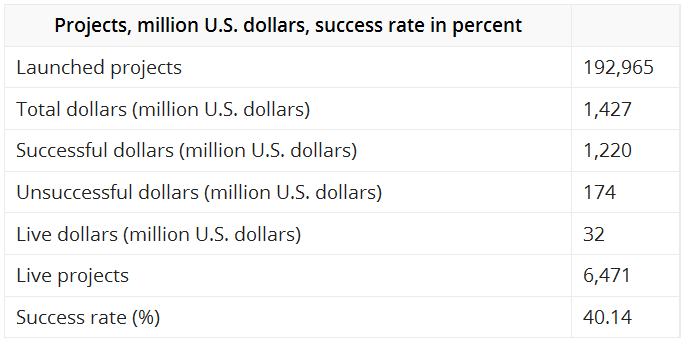

For those more analytically minded (ooh sexy), here are some spiffy charts and tables showing the most current Kickstarter statistics.

Glass half full: 40% fully funded

Glass half empty: 60% nada

Overview of projects and dollars on crowdfunding platform Kickstarter as of December 2014

All further information on this statistic can be found at Statista

Crowdfunding – All or Nothing

With Kickstarter crowdfunding (as with many such platforms) the project must be funded in its entirety, meaning the full amount requested, to receive the funds pledged.

If the projected goal is $10,000 and only $9,000 was pledged by the deadline, it’s tough luck. You get $0 of the $9,000. Ouch.

Not reaching the goal and failing to collect any monies does not necessarily mean it was a waste of effort. There are other benefits to setting up a crowdfunding project.

Crowdfunding Proof of Concept

Setting up a fund raising project at Kickstarter, Indiegogo or other crowdfunding platform, can be a great way to determine your product or service proof of concept.

Crowdfunding…a beautiful thing. – Guy Kawasaki

The incomparable Guy Kawasaki calls crowdfunding “a beautiful thing” (from his Udemy Entrepreneurship course). While speaking of Kickstarter and Indiegogo, he states that getting crowdfunding backers is proof that there is a market for your product. Whereas getting venture capital only proves that you convinced that backer that there is a market. That is not actual proof that there really is a market. Intersting theory don’t you think?

Failed Project = Dud?

- Is failure to attract funding on crowdfunding platforms an indication of the project’s success or failure?

- If a project was a dud and attracted little to no funds/backers, does that mean it, and conversley, the owner/creator is a dud?

- If the owner/creator proceeds with the project on his own, is he refusing to see the writing on the wall?

- Is he doomed to fail?

The Pollyanna answer would be no, of course not! No, or few, backers might simply mean the project owner failed to conduct a strong social strategy.

Social Social Social

Remember the Jan Brady Rule of Crowdfunding… SOCIAL, SOCIAL, SOCIAL!

The business crowdfunding site Fundable, sites an American Dream Composite Index survey that concluded:

- Age – Individuals ages 24-35 are much more likely to participate in crowdfunding campaigns

- Those over 45 are significantly less likely to back campaigns

- Gender – Men are much more likely to take a risk on an unknown startup

- Income – Those earning over $100,000 per year are the most likely to invest in startups through crowdfunding

Well that explains quite a lot. Since younger men are the more likely participants of crowdfunding campaigns (backers), and those earning over $100K are the ones backing startups through crowdfunding, it’s no wonder so few projects get funded.

Fundable further states: Social Media is a critical factor in crowdfunding success.

Ah, well, the plot thickens. Again, the majority of social media users are the younger demographic. To be fair, the older crowd is gaining ground. But for the purpose of crowdfunding, the social media savvy crowd with a pre-existing fan base (or followers), is much more likely to snag the crowdfunding dollars.

Crowdfunding as a Marketing Tool

Heck yeah. In addition to a Kickstarter crowdfunding campaign being a good proof of concept indicator, it can also be a great marketing tool.

The marketing angle works best for the fully funded project. Again, if the project owner has a strong social network, that network will continue the backing of the project beyond the cash commitment. If the backers love the product they will likely tweet and post and text all about it.

But beyond that circle of crowdfunding friends, the general media (i.e. mainstream journalists) is constantly on the prowl for feel-good crowdfunding stories. And that my friends is the ultimate in free publicity.

Title III Jobs Act

No, this is not the boring part of the movie where you take a pee break or the Oscars presentation where the Price Waterhouse suits make their awkward two minute speech. This is important stuff. So pay attention if you have any interest in stepping onto a crowdfunding platform for the big bucks.

The portion of the Jobs Act that hopeful entrepreneurs have been patiently awaiting, allows for a private party (the entrepreneur) to raise equity based funds (see below) using online crowdfunding platforms, to raise up to $1,000,000.00 (one million dollars).

The portion of the Jobs Act that hopeful entrepreneurs have been patiently awaiting, allows for a private party (the entrepreneur) to raise equity based funds (see below) using online crowdfunding platforms, to raise up to $1,000,000.00 (one million dollars).

This type of crowdfunding is currently illegal but the act is scheduled for another look-see (pass?) in October, 2015.

Tim Berry of the angel investment group Willamette Angel Conferencestates:

To be honest, I’m not that anxious to see real crowdfunding happening. I’m not at all sure it will be the boon to startups we all think.

Reward Funding vs Equity Funding

Crowdfunding sites such as Kickstarter and Indiegogo are based on simple rewards in exchange for money to back the project.

Rewards are typically an inexpensive item such as a tee shirt with the company’s logo. Or a copy of the item being produced with the proceeds, like a CD or book. The rewards usually are based on the dollar amount pledged. For example a tee shirt for a $25 pledge or a tee shirt plus a canvas bag for $50.

This type of funding works best for “smaller” funding goals that can realistically be met in the 60 day max deadline. Think in terms of a maximum goal of $50,000. More typical goals of Kickstarter type crowdfunding projects are around $10,000.

It is true that Kickstarter, Indiegogo and other crowdfunding platforms have had projects earn in the multi-million dollar realm, but of course those are not the norm.

With equity funding the owner gives up a piece of company in exchange for a cash infusion.

Crowdfunding Minus Advisors

That brings up another negative to crowdfunding…no advisors. An aspect of equity funding (think Venture Capital and tv’s Shark Tank) that is lacking with reward based crowdfunding, is the investor’s active role in your company. Because they take a stake in the company in exchange for a large cash infusion, they have a major interest in the company’s success.

This type of investor is usually sought after as much for their expertise as their cash. The savvy entrepreneur seeks out a Venture Capitalist with proven skills in business and/or direct experience in his industry. Their aim is to snag advice and siphon real guidance from this mentor. Their guidance could mean the difference between success and failure. With crowdfunding money you miss out on this valuable piece of the equation.

Crowdfunding Exposure Issue

Another thing that entrepreneurs need to aware of is the issue of being exposed to all the world. When you post a request for funding you post your product or business idea in all its glory. You need to show your idea and your plans in order to draw the attention of would-be backers. But by doing so you are left fully exposed. This means anybody can steal your idea. The founder of IndieGoGo, is quoted in Wikipedia as saying:

We get asked that all the time, ‘How do you protect me from someone stealing my idea?’ We’re not liable for any of that stuff.

Alrighty then. “We’re not liable for any of that stuff.” How does that make you feel? Wary? Leery? Distrustful? Maybe it should.

Kickstarter vs Indiegogo

Still want to get in on the crowdfunding action? Ok, but go in with eyes wide open.

Kickstarter and Indiegogo are the current crowdfunding platform faves. The two sites serve very different markets and have very different features.

When doing a side by side Kickstarter vs Indiegogo comparison (or any other crowdfunding sites) you must first determine:

- What are your needs and goals?

- Is your project for a business, cause or artistic endeavor?

If you are hoping to fund an artistic or creative project (and the terms are used pretty loosely in the crowdfunding universe) then Kickstarter is the platform of choice.

Kickstarter

⇒U.S. participants (limited international participants allowed)

⇒time limit 60 days

⇒creative projects only

⇒only fully funded projects pay out

⇒bigger reach=more eyes

Indiegogo

⇒international participants allowed

⇒any type of project

⇒no time limit to reach goal

⇒platform not as well known=less eyes

⇒all money pledged goes to project owner regardless if goal is met

Indiegogo is open to pretty much any type of project and is very casual with regards to rules. At first glance Indiegogo seems like a no brainer. You get to keep all funds regardless? Yep. But you need to dig deeper.

Data suggests that not placing a hard deadline on projects is conducive to complacency. Huh? Backers are in no huge rush to help. Potential backers might reason there is plenty of time and might hold off on placing their donation. And then they forget all about your project.

With Kickstarter deadlines the backers know it’s now or never. They know your project will fail if the total goal amount is not reached. They are more inclined to help knowing their pledge can actually make a difference.

Still want to Drink the Kickstarter Kool Aid?

If after reading all of this (wow) you still want in, here are some guidelines straight from Kickstarter and Indiegogo: