Internet of Things (IoT) has made a long trip from a test-bed technology to transforming multiple industries by creating value for both businesses and customers. Digital Transformation (DX) is by far not an easy feat, enterprises use IoT to improve new innovative products & services and business models to increase their revenues or to put down costs by improving automation and processes. Some of the strategic decisions that enterprises need to make in their IoT deployments are – selecting the most suitable connectivity technologies for their IoT assets, which has a long-term implication on enterprise’ financial and strategic goals.

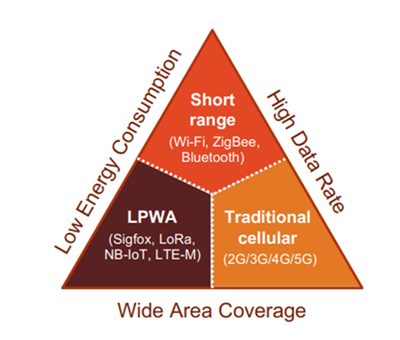

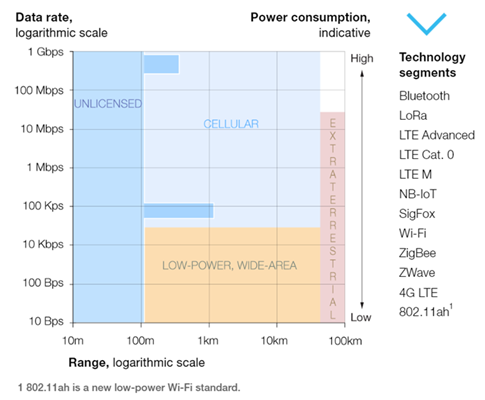

There are several alternatives’ enterprises can choose from when it comes to connectivity technologies – from traditional short-range technologies like Wi-Fi, BLE, ZigBee to cellular (2G, 3G, 4G, 5G) technologies and a range of LPWA (low-power wide area) technologies such as NB-IoT, LTE-M, LoRa and Sigfox, among others which has emerged in the last decade.

LPWA technologies have emerged as new connectivity technologies dedicated to IoT. The ability to connect things which was not possible in the past because of high costs and remote location, was fulfilled by LPWA low-power consumption and wide-area coverage characteristics. There are two main LPWA categories – licensed and unlicensed. Licensed LPWA technologies are based on 3GPP standards often referred as Cellular LPWA and consist of two technologies – NB-IoT (Narrowband IoT) and LTE-M or Cat M (long-term evolution for machines).

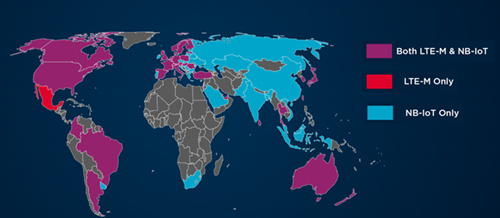

Licensed LPWA technologies are deployed by telecom operators on their managed networks licensed spectrum. The introduction of these technologies as cellular option to connect IoT assets was standardized by 3GPP in 2016 with first commercial deployment in 2017. According to GSMA until February 2022, 170 service providers have commercially deployed either NB-IoT, LTE-M and/or both technologies, globally. Out of these 170 – 110 service providers have deployed NB-IoT, 60 have deployed LTE-M whereas 42 out of these 60 have deployed both NB-IoT and LTE-M.

Source: GSMA IoT Deployment Map, Feb 2022 Update

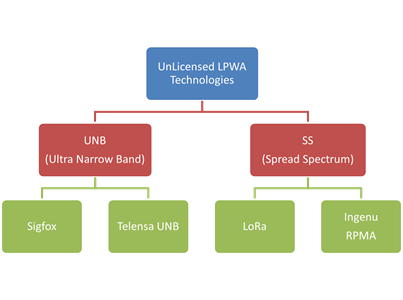

Unlicensed LPWA technologies are the proprietary technologies deployed by greenfield actors but also by telecom operators to fill the gap not covered by licensed LPWA and to address the sweet spot by providing connectivity with UNB (ultra-narrowband) based unlicensed technologies such as Sigfox and Telensa together with SS (Spread Spectrum) based technologies like LoRa and RPMA.

Sigfox: Sigfox gained its first -mover advantage in UNB space back in 2010. However, over the course of last 10 years Sigfox lost its prominence. Eventually, Sigfox filed for insolvency in Feb 2022 citing challenging times due to supply-chain crisis and Covid-19.

In April 2022, Unabiz a Singapore based IoT solution company had acquired the troubled Sigfox, since then the company is trying to bring some positivity to Sigfox customers and the market. Unabiz is planning to create an abstraction layer in cloud on top of different LPWA technologies to give its customers best connectivity coverage at cheap price for their IoT projects.

LoRa: Semtech developed LoRa building the chipsets and IoT products around LoRa technology. Enterprises can roll out their own IoT infrastructure using LoRa in unlicensed spectrum. LoRaWAN is a protocol specification developed by LoRa Alliance a non-profit, open association with over 500 members worldwide. LoRa provides a reliable option when there is no cellular or Wi-Fi coverage for IoT connectivity, the four key benefits of LoRa – long range, low bandwidth, long battery life and low cost.

Other Unlicensed LPWA Technologies: Vendors in this category include Weightless SIG (with companies like Neul), and other UNB companies using ISM (Industrial, Scientific and Medical) bands for low data rate applications such as Telensa (for applications such as smart street lighting).

Another technology developed by Ingenu (formerly On-Ramp Wireless) using ISM band is a SS-based LPWA technology with their proprietary Random Phase Multiple Access (RPMA) technology.

LPWA Characteristics

Any IoT connectivity technology including both licensed and unlicensed LPWA technologies can’t cover the vast variety of IoT applications and enterprises need to select connectivity technology based on specific use cases and would always have to face some trade-offs either on coverage, data rates and/or energy consumption.

LPWA technologies have wide-area coverage and can be reached remote locations with deep indoor penetration compared to traditional cellular IoT technologies. Moreover, most of the LPWA technologies have low energy consumption compared to their counterparts and have much lower data rates.

Source: Mckinsey

Analysis

Market Overview

The LPWA (low-power wide-area) market has seen a strong and steady growth over the past years. Some of the key drivers in LPWA market growth are – adoption of LPWA technologies across industries, strong ecosystem of players (vendors & telecom operators), 2G/3G network sunset, wider devices/modules/components portfolio, and a strong market in China.

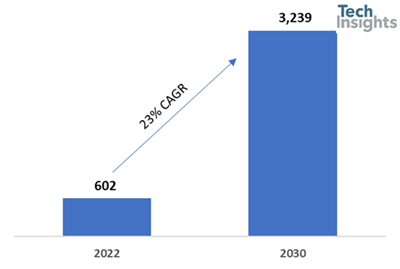

TechInsights forecasts that the total IoT LPWA Connections will grow from 602 million in 2022, to 3239 million by 2030 at a CAGR of 23%.

Global LPWA Connections (in millions)

Source: IoT LPWA Connections: A Complete View by Regions & Verticals 2022-2030, IoT Strategies, TechInsights

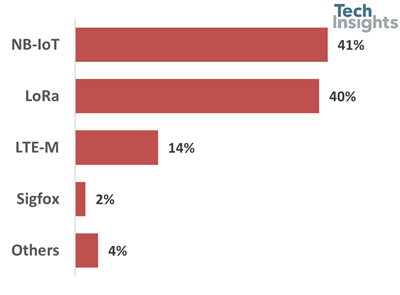

NB-IoT has surpassed LoRa as the leading LPWA technology in 2022, followed by LTE-M. By 2029, LTE-M will capture a greater share than LoRa.

LPWA Connections Technology Split in 2022 (in %)

Source: IoT LPWA Connections: A Complete View by Regions & Verticals 2022-2030, IoT Strategies, TechInsights